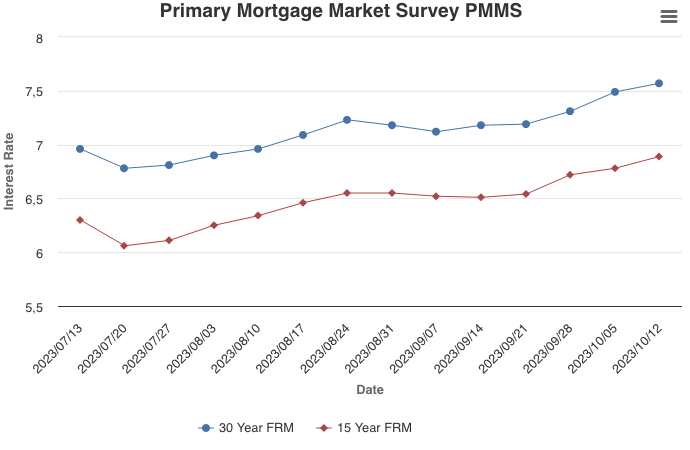

October 12, 2023

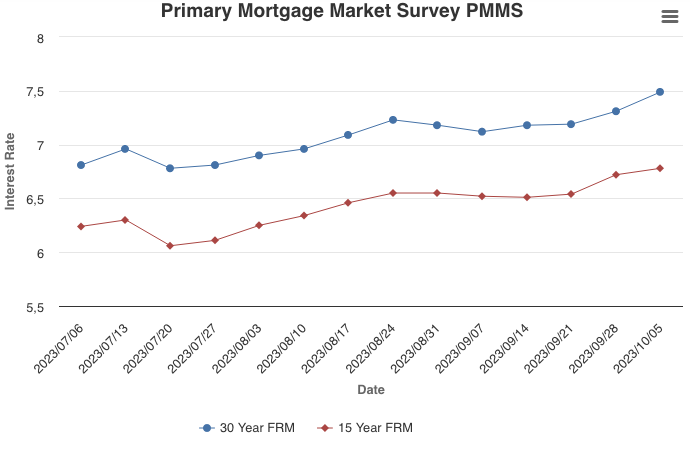

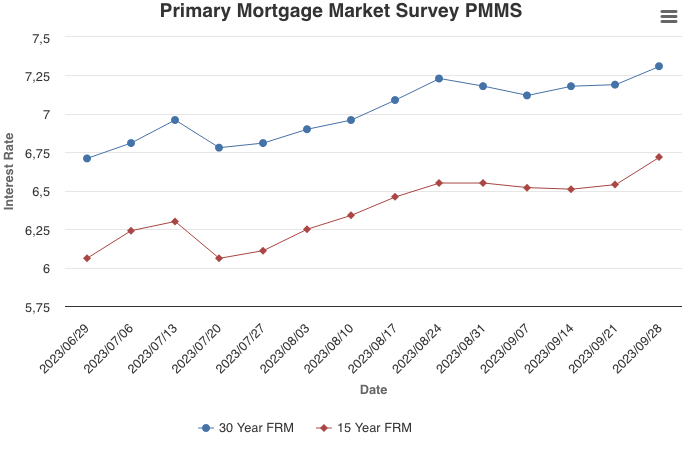

For the fifth consecutive week, mortgage rates rose as ongoing market and geopolitical uncertainty continues to increase. The good news is that the economy and incomes continue to grow at a solid pace, but the housing market remains fraught with significant affordability constraints. As a result, purchase demand remains at a three-decade low.

Information provided by Freddie Mac.

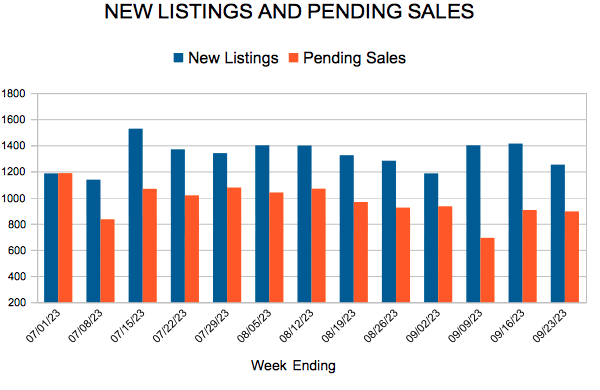

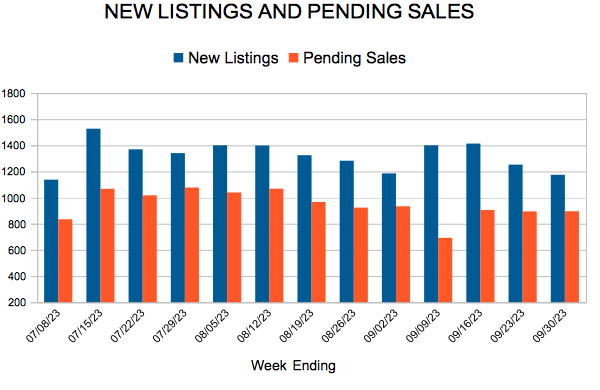

For Week Ending September 30, 2023

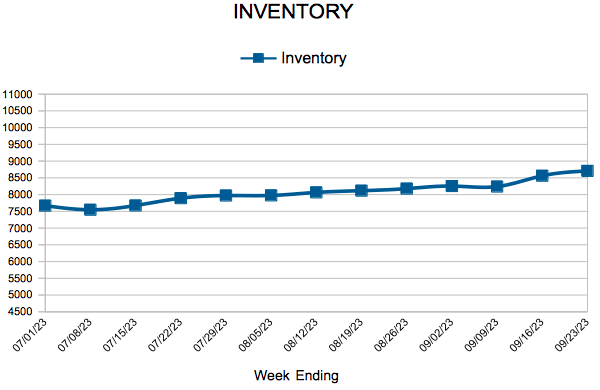

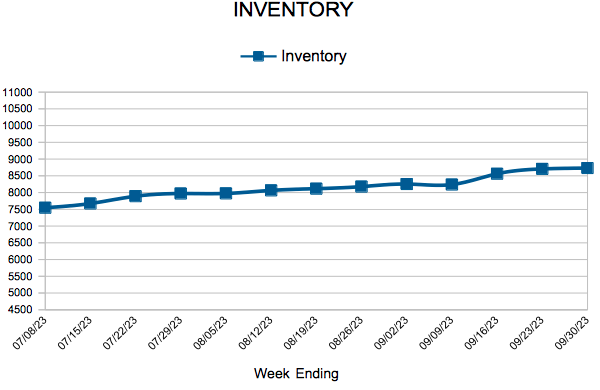

For Week Ending September 30, 2023