For Week Ending June 15, 2024

For Week Ending June 15, 2024

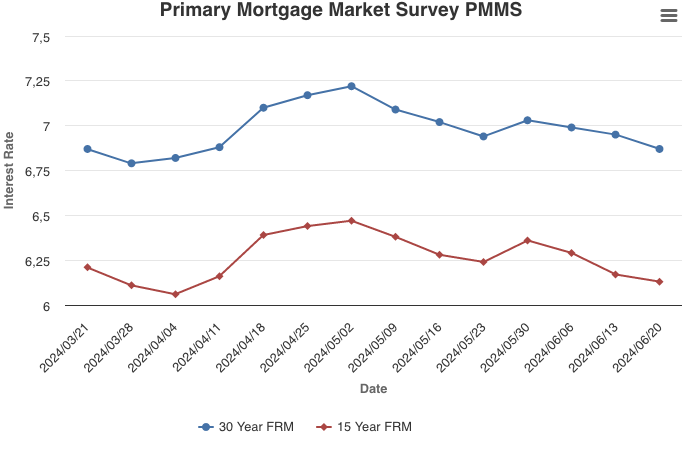

U.S. mortgage performance is in good health overall, according to CoreLogic’s May 2024 Loan Performance Insights report, which found overall delinquency, serious delinquency, and foreclosure rates remained low as of last measure in March 2024. The report notes that just 2.8% of mortgages were delinquent by at least 30 days or more, a 0.2% change from the same period a year before, while serious delinquency and foreclosure inventory rates were 0.9% and 0.3%, respectively.

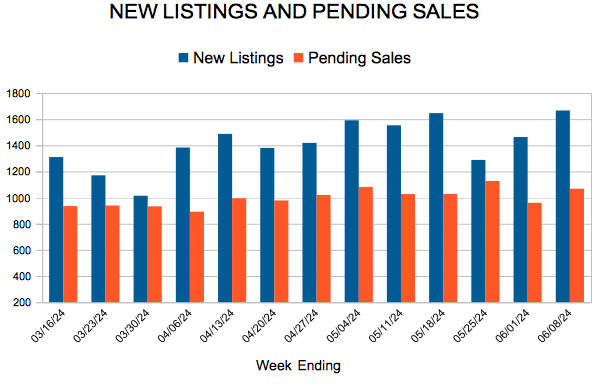

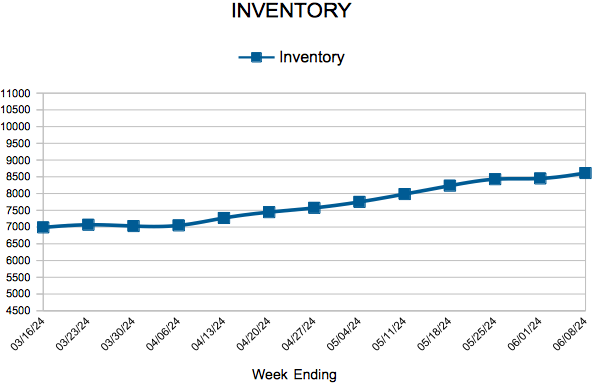

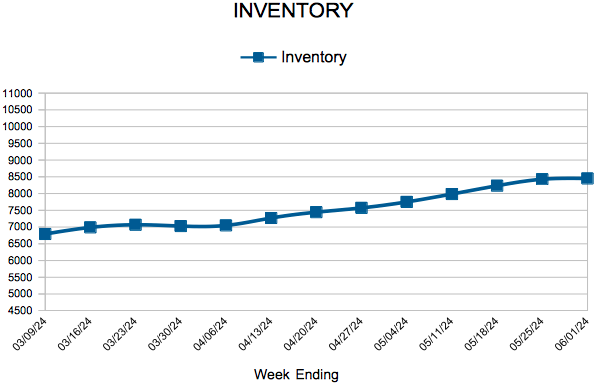

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 15:

- New Listings decreased 1.6% to 1,564

- Pending Sales decreased 10.8% to 1,033

- Inventory increased 12.8% to 8,800

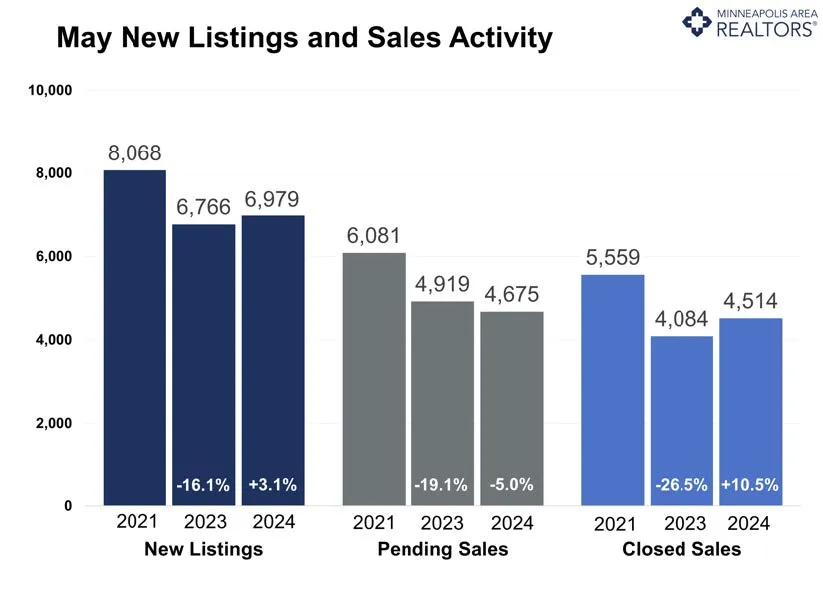

FOR THE MONTH OF MAY:

- Median Sales Price increased 4.1% to $385,000

- Days on Market increased 5.3% to 40

- Percent of Original List Price Received decreased 1.0% to 100.1%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.