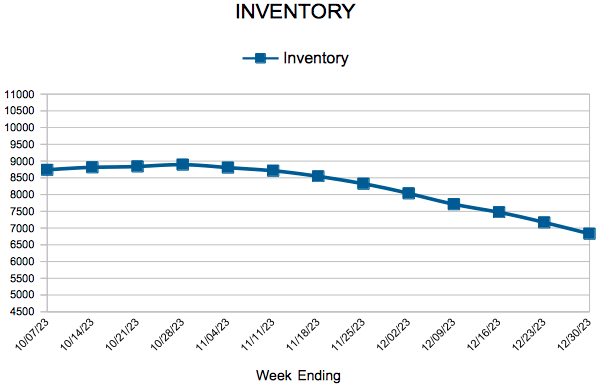

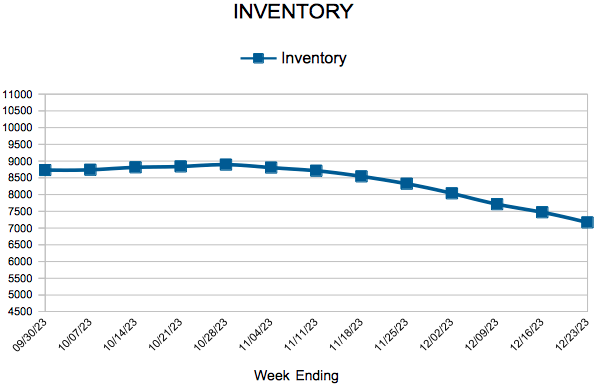

Inventory

Weekly Market Report

For Week Ending December 30, 2023

For Week Ending December 30, 2023

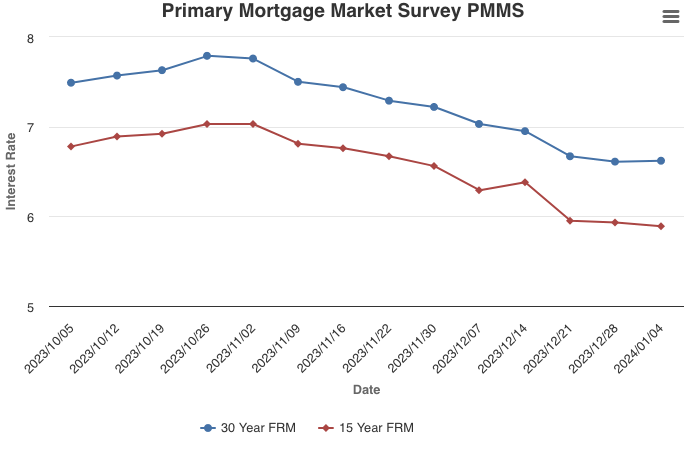

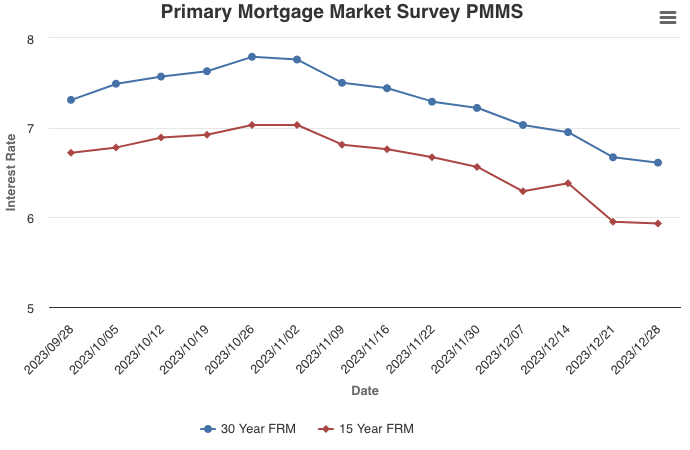

U.S housing starts surged following the drop in mortgage rates, jumping 14.8% from the previous month to a seasonally adjusted annual rate of 1,560,000 units, according to the U.S. Census Bureau. The latest reading was boosted by an increase in single-family starts, which climbed 18% from the previous month. Housing completions were also up, rising 5% month-over-month. The average 30-year fixed-rate mortgage has fallen more than one percentage point since its peak in late October, leading to an increase in building activity and builder sentiment.

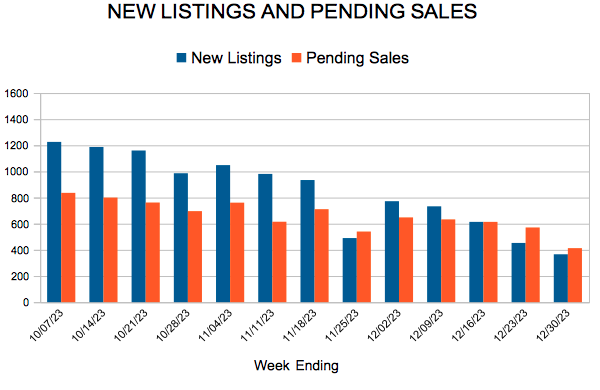

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 30:

- New Listings increased 6.7% to 366

- Pending Sales increased 1.2% to 413

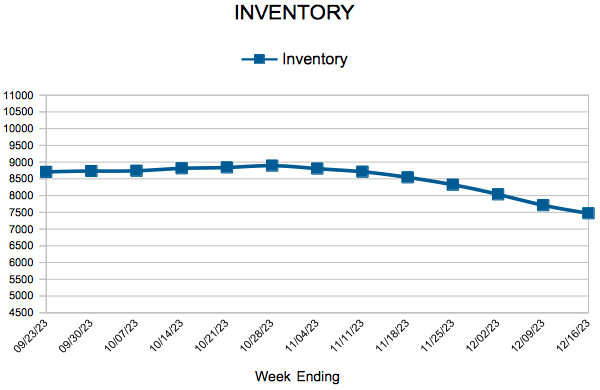

- Inventory decreased 5.3% to 6,831

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,550

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Move Sideways as Markets Digest Incoming Data

January 4, 2024

Between late October and mid-December, the 30-year fixed-rate mortgage plummeted more than a percentage point. However, since then rates have moved sideways as the market digests incoming economic data. Given the expectation of rate cuts this year from the Federal Reserve, as well as receding inflationary pressures, mortgage rates will likely continue to drift downward as the year unfolds. While lower mortgage rates are welcome news, potential homebuyers are still dealing with the dual challenges of low inventory and high home prices that continue to rise.

Information provided by Freddie Mac.

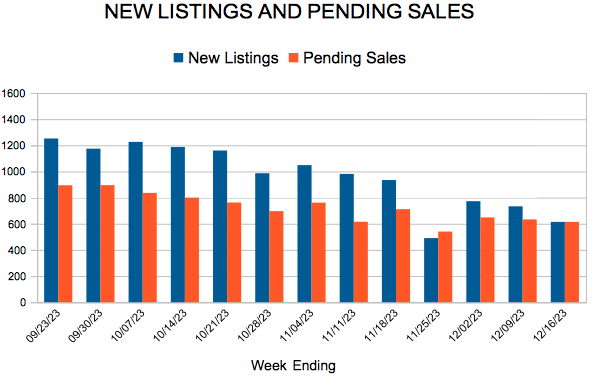

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 23, 2023

For Week Ending December 23, 2023

The median household income for U.S. homebuyers hit a record high of $107,000 recently, a 21.6% increase from a year ago, according to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers. Despite higher home prices and rising borrowing costs, the share of first-time buyers also grew, increasing from 26% in 2022 to 32% this year. Down payments continued to climb as well, with the typical down payment for first-time buyers averaging 8%, the highest share since 1997, according to the report.

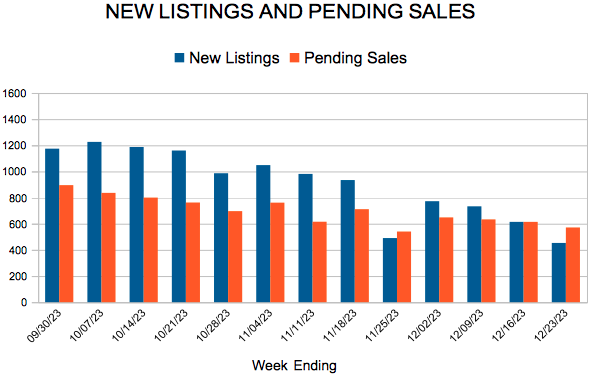

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 23:

- New Listings increased 37.3% to 453

- Pending Sales increased 20.7% to 571

- Inventory decreased 4.3% to 7,167

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Heading into the New Year, Mortgage Rates Remain on a Downward Trend

December 28, 2023

The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down. Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 44

- 45

- 46

- 47

- 48

- …

- 135

- Next Page »