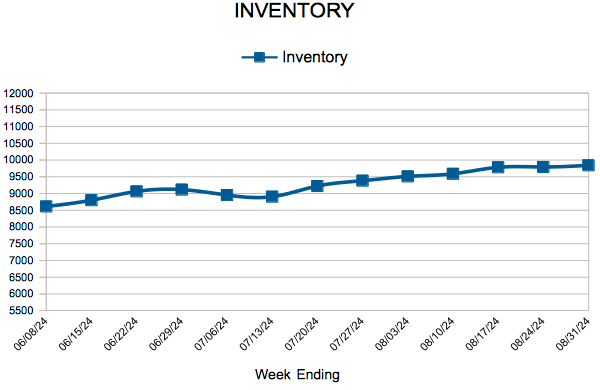

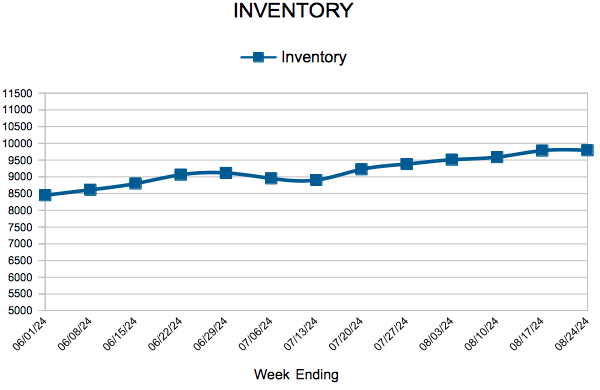

Inventory

Weekly Market Report

For Week Ending August 31, 2024

For Week Ending August 31, 2024

49.2% of mortgaged residential properties in the U.S. were considered equity rich—having at least 50% equity in one’s home–in the second quarter of 2024, according to ATTOM’s Q2 2024 U.S. Home Equity and Underwater Report. This is an increase from the previous quarter, when 45.8% of mortgaged homes were considered equity-rich, with the largest quarterly increases found in lower-priced markets in the South and Midwest regions.

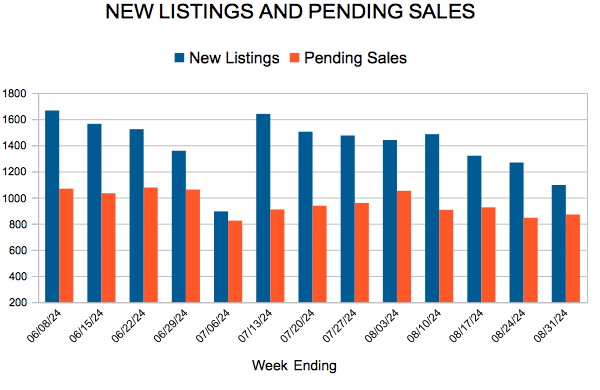

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 31:

- New Listings decreased 10.7% to 1,096

- Pending Sales decreased 8.5% to 870

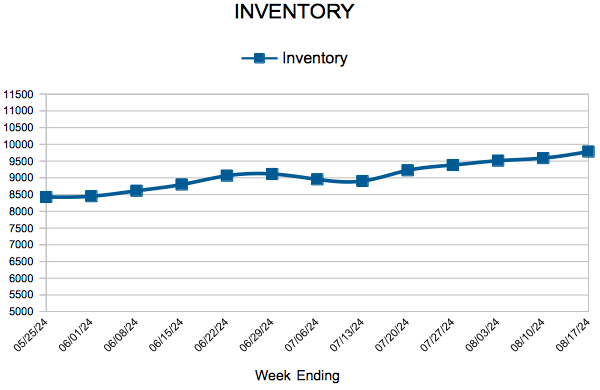

- Inventory increased 12.7% to 9,842

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.7% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

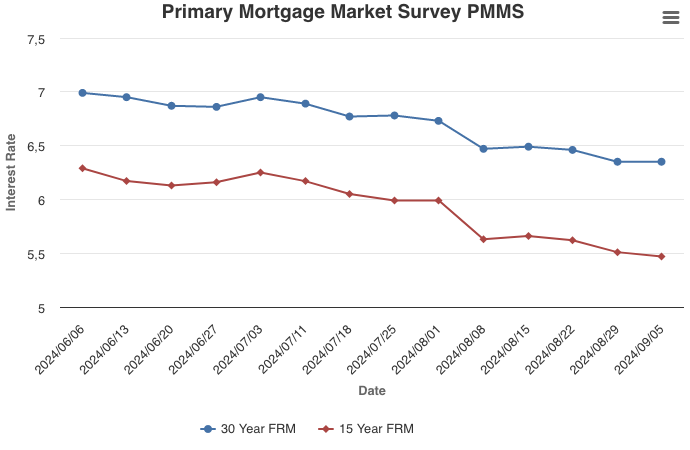

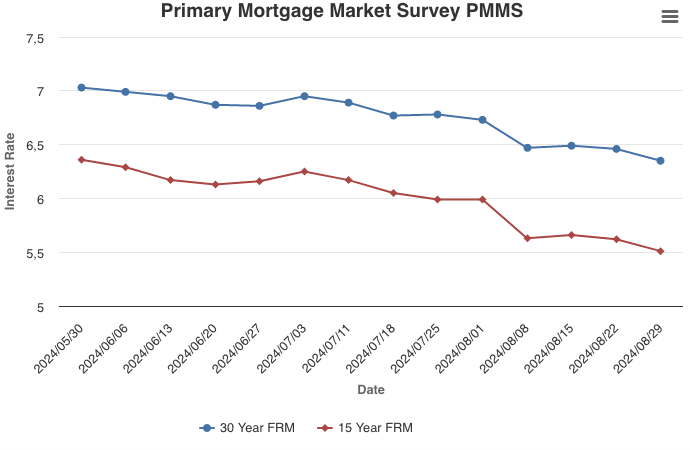

Mortgage Rates Remained Flat This Week

September 5, 2024

Mortgage rates remained flat this week as markets await the release of the highly anticipated August jobs report. Even though rates have come down over the summer, home sales have been lackluster. On the refinance side however, homeowners who bought in recent years are taking advantage of declining mortgage rates in order to lower their monthly payments.

Information provided by Freddie Mac.

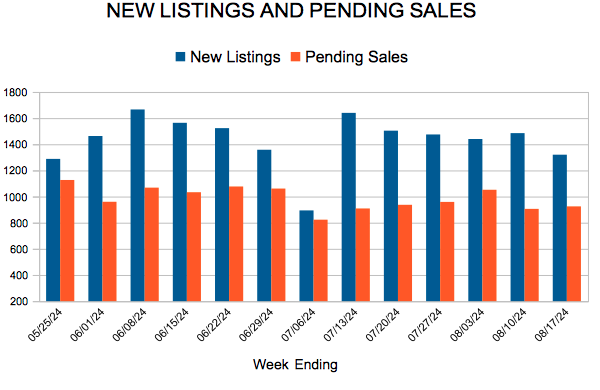

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 24, 2024

For Week Ending August 24, 2024

U.S. housing starts fell 6.8% month-over-month and 16.0% year-over-year to a seasonally adjusted annual rate of 1,238,000 units, according to the U.S. Census Bureau. Building permits also declined as of last measure, sliding 4% month-over-month to a seasonally adjusted annual rate of 1,396,000 units. Analysts say Hurricane Beryl, along with elevated interest rates in July, likely impacted construction activity.

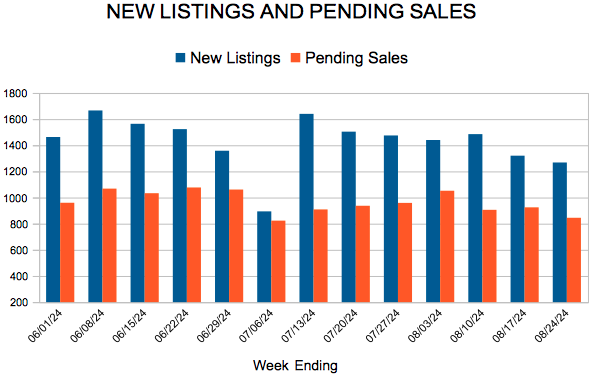

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 24:

- New Listings decreased 3.9% to 1,268

- Pending Sales decreased 9.2% to 845

- Inventory increased 13.6% to 9,793

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.1% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Drop

August 29, 2024

Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are watching closely, a rebound in purchase activity remains elusive until further declines are seen.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 28

- 29

- 30

- 31

- 32

- …

- 135

- Next Page »