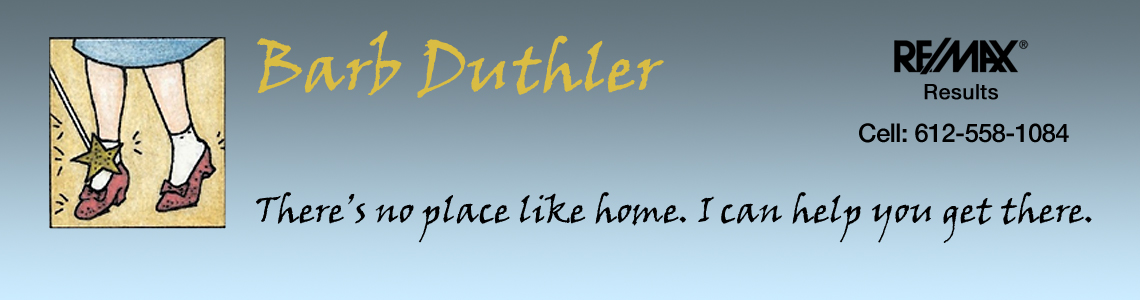

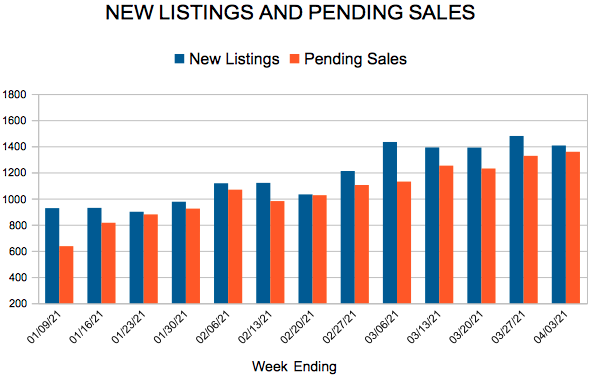

New Listings and Pending Sales

New Listings and Pending Sales

Tight market pushes home prices to new record high in Twin Cities

Inventory hits an 18-year low with buyers competing for fewer listings

(April 16, 2021) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the median price of a home in the 16-county Twin Cities metro increased 10.3 percent from last March to a record high of $327,500. Prices were driven in part by a lack of supply.

The number of homes for sale at the end of March was half of what was available a year ago. That marks an 18-year low and amounts to 0.9 months of supply. A balanced market typically has 4-6 months of supply. Market times shrank 37.7 percent to 38 days and multiple offers remain commonplace.

“Demand is still growing faster than supply,” according to Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “With less than one month of supply, buyers must be patient and understand they may lose out on a few bids before an offer is accepted. Be ready to act fast.”

Sellers listed 11.6 percent fewer homes than March 2020, offering little relief to buyers eager for more options. However, sales activity climbed above year-ago levels for the tenth straight month. Buyers continue to be motivated by attractive mortgage rates, a healing labor market and a desire for more space.

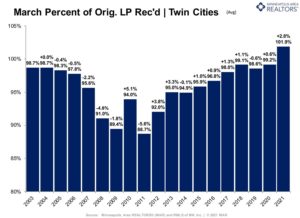

“On top of lightning-fast market times, those who choose to sell their home are often rewarded with offers at or above asking price,” said Todd Walker, President of Minneapolis Area REALTORS®. “For buyers, that means writing strong, straightforward offers right away. For sellers, it means their listings will stand out and will likely sell quickly at full price or better.”

Activity varies by area, price point and property type. Sales were up 31.9 percent in Minneapolis and 9.5 percent in St. Paul, suggesting demand remains strong in the core cities. Condos sales rose 31.7 percent, outpacing single-family and townhomes. New construction sales rose 25.5 percent while previously owned homes rose 0.7 percent. Sales of luxury properties ($1M+) have been soaring—up 70.9 percent from last March.

March 2021 by the numbers compared to a year ago

- Sellers listed 6,587 properties on the market, an 11.6 percent decrease from last March

- Buyers signed 5,747 purchase agreements, up 12.1 percent (4,342 closed sales, up 2.9 percent)

- Inventory levels fell 50.7 percent to 4,907 units

- Months Supply of Inventory was down 52.6 percent to 0.9 months (4-6 months is balanced)

- The Median Sales Price rose 10.3 percent to $327,500

- Days on Market decreased 37.7 percent to 38 days, on average (median of 11, down 57.7 percent)

- Changes in Sales activity varied by market segment

- Single family sales were down 1.1 percent; condo sales rose 31.7 percent; townhome sales increased 8.7 percent

- Traditional sales rose 4.5 percent; foreclosure sales were down 42.9 percent; short sales fell 63.2 percent

- Previously owned sales were up 0.7 percent; new construction sales climbed 25.2 percent

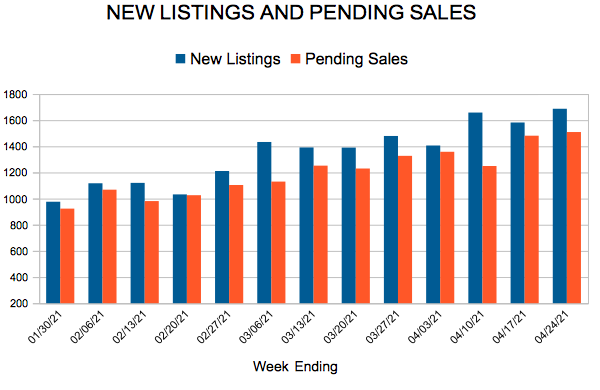

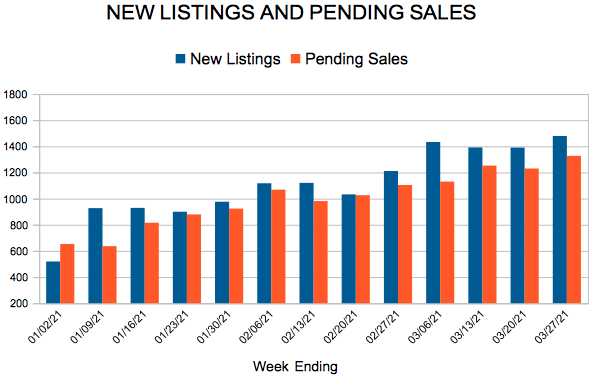

New Listings and Pending Sales

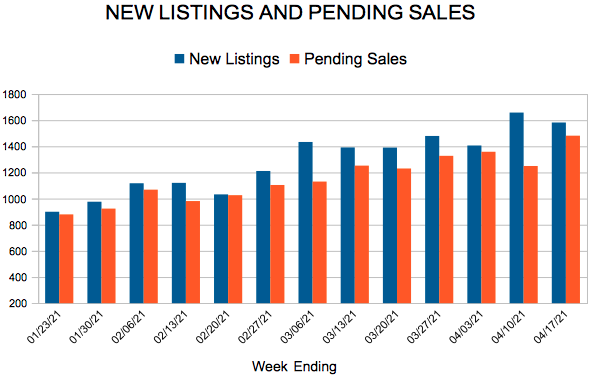

New Listings and Pending Sales

Twin Cities housing market still hot, but sales growth flattening

(March 17, 2021)

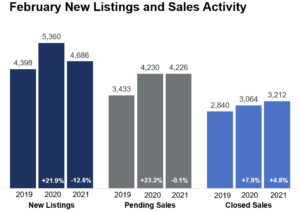

– According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, sales activity in the 16-county Twin Cities metro continues to climb above 2020 levels while the number of signed purchase agreements flattened out. Closed sales rose 4.8 percent from last February, which was the highest figure since at least 2003. While new signed purchase agreements were also the strongest since 2005, they were down 0.1 percent from last year, suggesting low supply could be constraining sales.

The number of homes on the market is now at a 20-year low. Sellers listed 12.6 percent fewer homes than February 2020, further shrinking a slim pool of available homes and befuddling home shoppers who continue to show up in record numbers.“We’re seeing lots of factors at play right now,” according to Todd Walker, President of Minneapolis Area REALTORS®. “Buyers are running up against the inventory shortage even as they’re inspired by 50-year low mortgage rates. We’re seeing shifting attitudes around urban living and condos. People are also very encouraged by the progress on the vaccination front.”

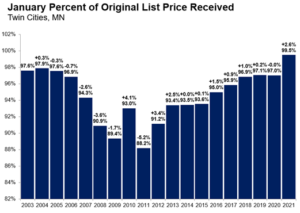

The number of homes for sale in February was down 46.3 percent compared to a year ago. That amounts to 0.8 months of supply, while a balanced market has 4-6 months of supply. At 100.1 percent of list price, sellers are still benefiting from historically strong offers, often over asking price and with multiple bids. Homes are selling in record time—half the listings in February sold in under 19.5 days. Home prices rose notably, up 11.5 percent from last February. Historically low rates can partly offset rising prices.

“With so many buyers vying over a shrinking pool of listings, well-priced and well-staged homes don’t spend much time on the market,” said Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “That means buyers have to come out swinging right out of the gate with their best offer in order to be successful.”

Though pending sales were down 0.1 percent metro-wide, they were up 23.3 percent in Minneapolis and 8.4 percent in St. Paul, indicating buyer interest remains strong in the urban core. Condos also saw the strongest demand growth in both pending and closed sales. New construction sales rose 32.5 percent compared to a 2.6 percent increase for previously owned homes. Sales of luxury properties ($1M+) have been strong—up 53.1 percent from last February.

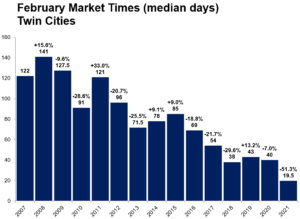

February 2021 by the numbers compared to a year ago

- Sellers listed 4,686 properties on the market, a 12.6 percent decrease from last February

- Buyers signed 4,226 purchase agreements, down 0.1 percent (3,212 closed sales, up 4.8 percent)

- Inventory levels fell 46.3 percent to 4,670 units

- Months Supply of Inventory was down 52.9 percent to8 months (4-6 months is balanced)

- The Median Sales Price rose 11.5 percent to $314,000

- Days on Market decreased 31.3 percent to 46 days, on average (median of 19.5, down 51.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales were up 8.0 percent; condo sales rose 27.9 percent; townhome sales decreased 10.1 percent

- Traditional sales rose 7.9 percent; foreclosure sales were down 51.3 percent; short sales fell 68.8 percent

- Previously owned sales were up 2.6 percent; new construction sales climbed 32.5 percent

Twin Cities housing market off to strong start for the year

Sales up, price growth strong, market times fast, but new listings down and supply levels very low

(February 17, 2021) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyer activity in the 16-county Twin Cities metro continues to climb above 2020 levels. Closed sales rose 14.6 percent from last January and new signed purchase agreements were up 5.6 percent over last year. That marks the strongest January pending sales since 2005 and the highest closed sales figure since at least 2003.

Despite the unyielding commitment from buyers in 2020, there are not enough homes on the market—particularly in the affordable ranges—to satisfy the historic demand. Sellers listed 8.8 percent fewer homes than January 2020, further shrinking an already historically low inventory of available homes.

“Last year was incredibly strong and so far 2021 is keeping up the pace,” according to Todd Walker, President of Minneapolis Area REALTORS®. “Rates are as attractive as they’ve ever been and the demand is persistent, but the challenge is still the lack of supply.”

The number of homes for sale in January was down 42.6 percent compared to a year ago. That amounts to 0.9 months of supply, while a balanced market has 4-6 months of supply. This dynamic has given rise to four other trends: sellers are getting historically strong offers, homes are selling in record time, multiple offers and competitive bidding have become commonplace and home prices are rising quickly relative to incomes.

“There are many motivated buyers out there but not nearly enough homes for them on the market,” said Tracy Baglio, President of the Saint Paul Area Association of REALTORS®. “Proper pricing is still critical, but sellers are accepting offers that are at or very close to list price, occasionally above it in the first-time buyer segments.”

Pending sales were up 39.4 percent in Minneapolis and 14.0 percent in St. Paul, indicating buyer interest remains quite strong in the core cities. Perhaps surprisingly, condos saw the strongest sales growth followed by single family and then townhomes. New construction sales rose 12.2 percent compared to a 16.0 percent increase for previously owned homes. Sales of luxury properties ($1M+) have been rallying—up 75.0 percent from last January.

For more information on weekly and monthly housing numbers visit www.mplsrealtor.com or www.spaar.com

January 2021 by the numbers compared to a year ago

- Sellers listed 3,989 properties on the market, an 8.8 percent increase from last January

- Buyers signed 3,519 purchase agreements, up 5.6 percent (3,335 closed sales, up 14.6 percent)

- Inventory levels fell 42.6 percent to 4,823 units

- Months Supply of Inventory was down 47.1 percent to9 months (5-6 months is balanced)

- The Median Sales Price rose 11.5 percent to $301,000

- Days on Market decreased 37.3 percent to 42 days, on average (median of 22, down 50.0 percent)

- Changes in Sales activity varied by market segment

- Single family sales were up 16.3 percent; condo sales rose 18.3 percent; townhome sales increased 7.8 percent

- Traditional sales rose 16.2 percent; foreclosure sales were down 35.1 percent; short sales fell 44.4 percent

- Previously owned sales were up 16.0 percent; new construction sales climbed 12.2 percent

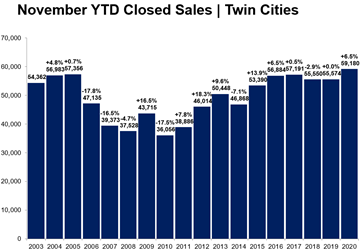

Despite the headwinds, 2020 was a record-breaking year for housing

Seller activity rose a modest 0.1 percent from 2019 while closed sales were up 7.7 percent. That marks the highest sales figure since at least 2003 and the highest new listings count since 2016. Listing activity was constrained due to health concerns, remodeling activity, a lack of options and homeowners staying in their homes longer.

“Predictably, the result of record sales combined with ultra-low inventory meant rising prices and sellers accepting stronger offers in less time,” according to Tracy Baglio, President of the Saint Paul Area Association of REALTORS®.

Governor Walz’s shelter-in-place order paused market activity in April and May, which created pent-up demand that pushed the spring market into summer and the summer market into fall. Buyers were still more eager to purchase than sellers were to list, meaning multiple offers remained commonplace—particularly at the more affordable price points where the inventory shortage is even more pronounced.

“Despite several challenges, the Twin Cities housing market exceeded all expectations,” said Todd Walker, President of Minneapolis Area REALTORS®. “Inventory remained a hurdle, but homeowners have never had so much equity in their homes and buyers haven’t seen rates this low in 50 years, offsetting rising prices.”

The median sales price rose 8.9 percent to $305,000, a record high. On average, sellers obtained 99.8 percent of their list price—the highest since at least 2003. Homes sold quickly. Half the sales had accepted offers in under 18 days. Importantly, all areas, price points and property types are unique.

Signed contracts rose 10.0 percent in Minneapolis and 16.4 percent in St. Paul, suggesting core cities remain attractive. With prices slightly lower, market times higher and offers weaker, the condo market continues to lag other segments. Aided by favorable jumbo rates and a recovered stock market, sales of luxury properties ($1M+) have been soaring higher—up 25.4 percent from 2019.

One thing is clear: the housing market continues to outperform, despite several headwinds.

2020 by the numbers (compared to 2019)

• Sellers listed 76,348 properties on the market, a 0.1 percent increase from 2019

• Buyers closed on 64,479 properties, up 7.7 percent (65,770 pending sales, up 9.7 percent)

• The Median Sales Price rose 8.9 percent to $305,000

• Inventory levels fell 39.3 percent to 5,080 units

• Months Supply of Inventory was down 47.1 percent to 0.9 months (5-6 months is balanced)

• Days on Market decreased 12.2 percent to 43 days, on average (median of 18, down 21.7 percent)

• Changes in Sales activity varied by market segment

- Single family sales were up 10.8 percent; condo sales fell 10.6 percent; townhome sales increased 3.4 percent

- Traditional sales rose 8.4 percent; foreclosure sales were down 20.9 percent; short sales fell 25.9 percent

- Previously owned sales were up 7.3 percent; new construction sales climbed 14.1 percent

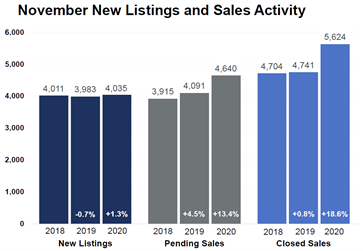

Despite pandemic, this year is on-track for record-breaking sales

(December 17, 2020) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the growth in buyer and seller activity in the 16-county Twin Cities metro continues to climb above 2019 levels. Seller activity rose 1.3 percent from last November while new purchase agreements were up 13.4 percent over last year. That marks the strongest November pending sales figure since 2004 and the highest closed sales since at least 2003.

This year, the fall and winter markets are behaving more like a spring market since activity was delayed from the spring and summer months. While sellers only listed slightly more units than last November, pending and closed sales were up significantly. Pending sales often act as a leading indicator of future demand while closings lag.“The Twin Cities housing market continues to exceed expectations,” according to Patrick Ruble, President of the Saint Paul Area Association of REALTORS®. “Despite record sales figures, the lack of adequate supply—particularly affordable units—continues to frustrate buyers.”

Historically low mortgage rates, shifting work and learning patterns, health concerns and other factors are driving this sellers’ market. While all areas and price points are unique, sellers are getting strong offers early on. On average, sellers obtained 100.2 percent of their original list price—the highest November figure since at least 2003. At a median of 15 days, homes went under contract in record time, and 48.3 percent faster than last November.

“It’s truly impressive that sales would reach new highs during a pandemic and an otherwise challenging year,” said Linda Rogers, President of Minneapolis Area REALTORS®. “That’s of course meant rising home prices, but luckily, ultra-low interest rates have been able to partly offset that.”

Sales were up 21.5 percent in Minneapolis and 30.8 percent in St. Paul, suggesting buyers are eager to quickly snap up any new listings. And the competitive landscape means those buyers are often going above list price. With prices slightly lower, market times higher and offers weaker, the condo market continues to lag other segments. However, sales of luxury properties ($1M+) have been soaring higher—up nearly 20.0 percent YTD. One thing is clear: the housing market continues to outperform, despite the many economic headwinds.

November 2020 by the numbers compared to a year ago

- Sellers listed 4,035 properties on the market, a 1.3 percent increase from last November

- Buyers signed 4,640 purchase agreements, up 13.4 percent (5,624 closed sales, up 18.6 percent)

- Inventory levels fell 37.9 percent to 6,642 units

- Months Supply of Inventory was down 42.9 percent to2 months (5-6 months is balanced)

- The Median Sales Price rose 10.7 percent to $310,000

- Days on Market decreased 33.3 percent to 34 days, on average (median of 15, down 48.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales were up 21.3 percent; condo sales fell 2.6 percent; townhome sales increased 20.6 percent

- Traditional sales rose 19.7 percent; foreclosure sales were down 22.9 percent; short sales fell 18.8 percent

- Previously owned sales were up 21.7 percent; new construction sales climbed 4.8 percent