For Week Ending August 14, 2021

For Week Ending August 14, 2021

High home prices are the most common reason prospective buyers have yet to purchase a home, with 39% of active buyers mentioning high sales prices as the primary deterrent to not finding a home in Q2 2021, according to a recent Housing Trends report from the National Association of Home Builders. This is a change from the previous two quarters, where interested buyers reported being outbid by other offers as the most common reason for not purchasing a home.

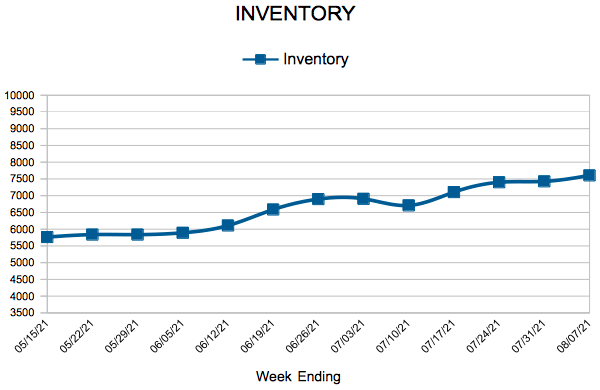

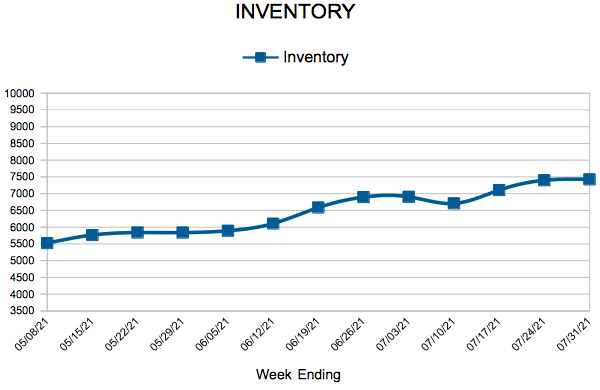

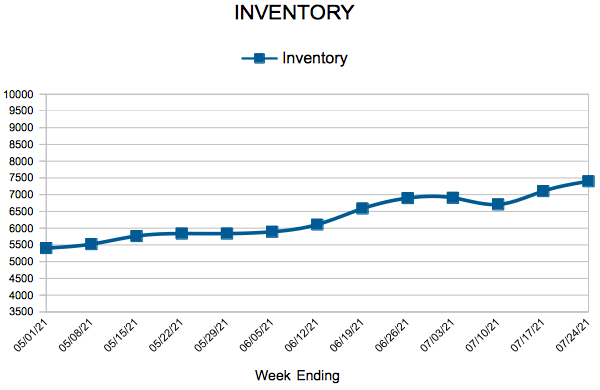

In the Twin Cities region, for the week ending August 14:

- New Listings decreased 11.7% to 1,697

- Pending Sales decreased 8.0% to 1,503

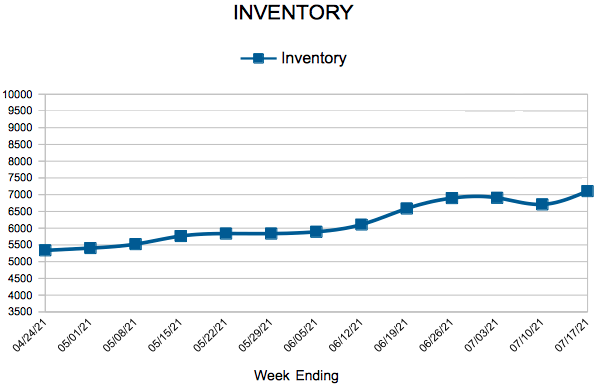

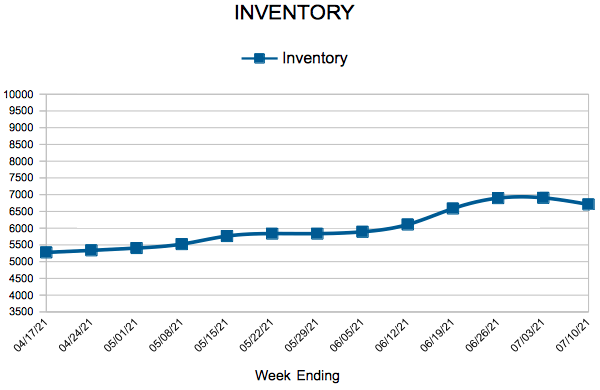

- Inventory decreased 19.3% to 7,901

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.