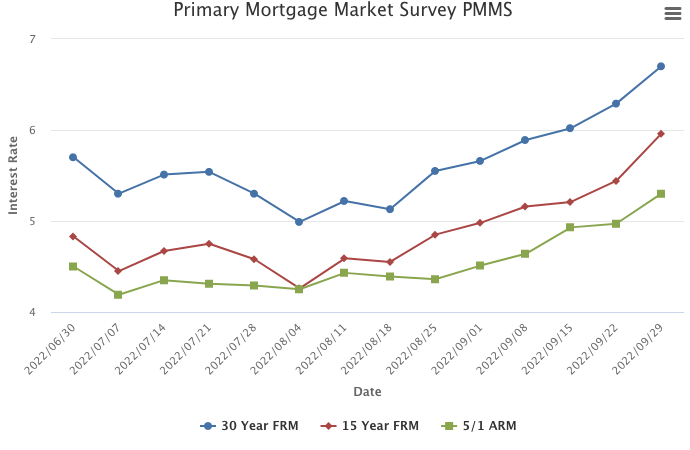

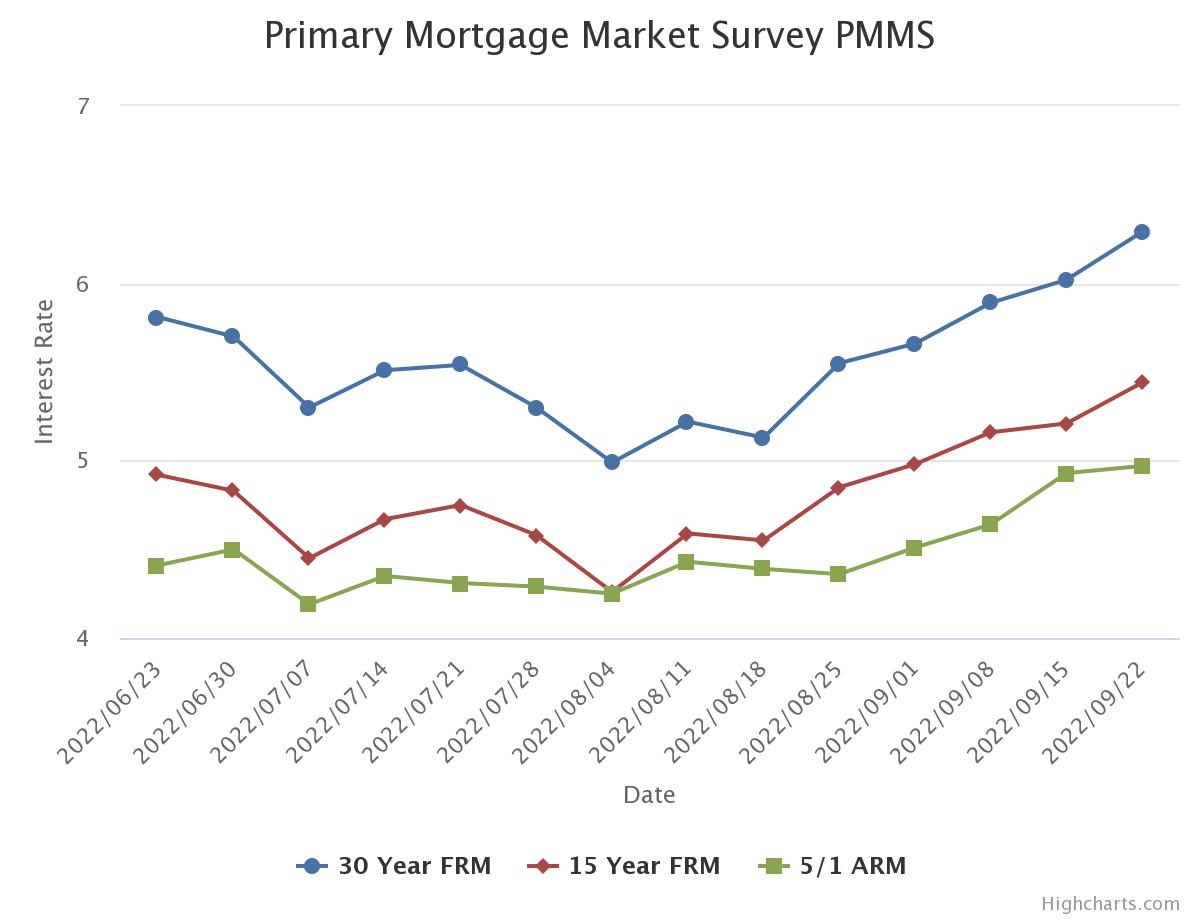

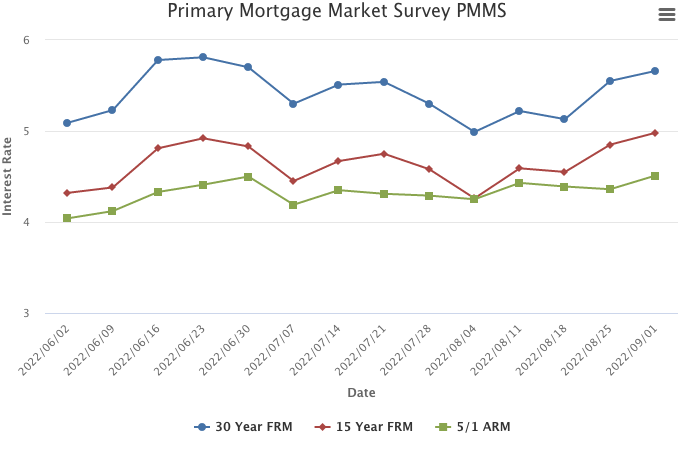

October 6, 2022

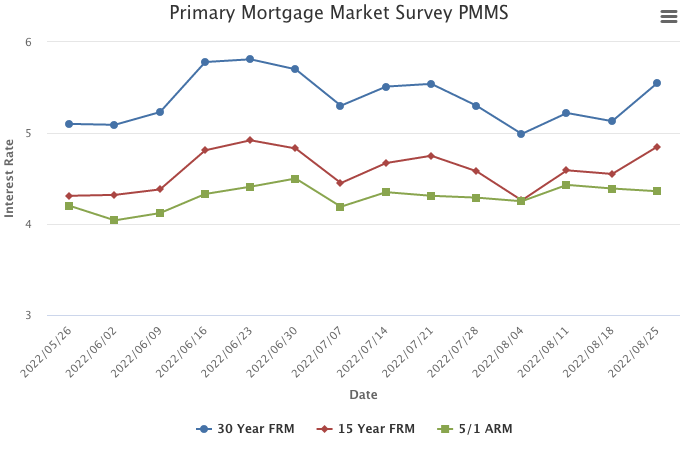

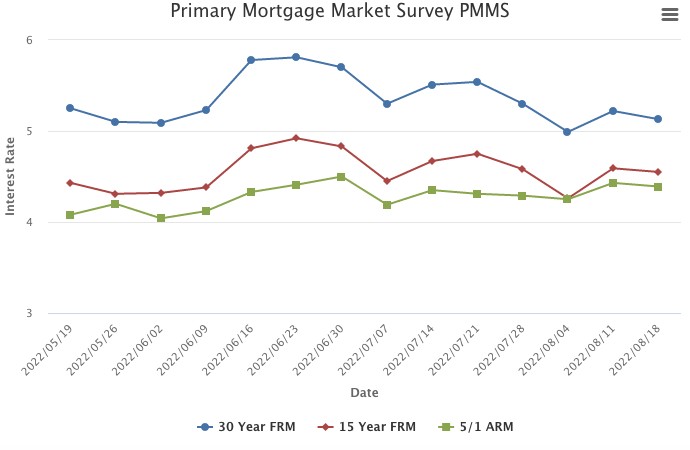

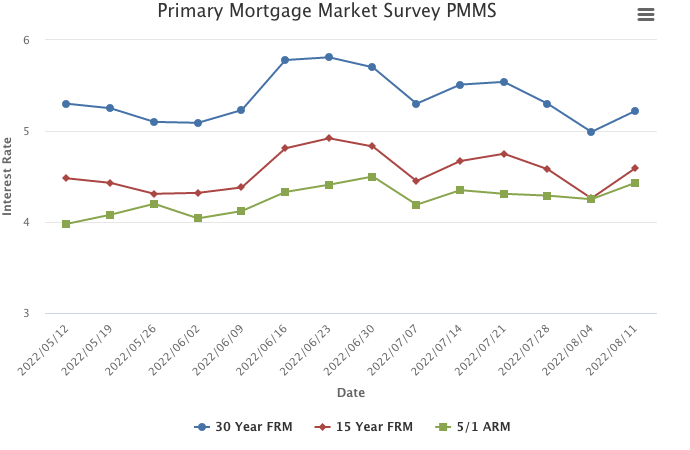

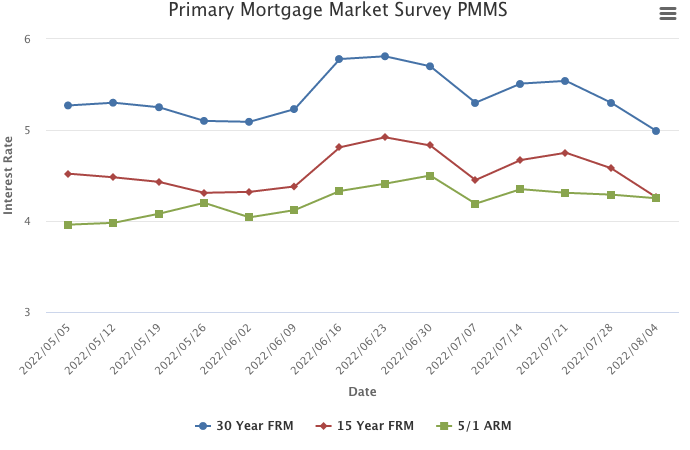

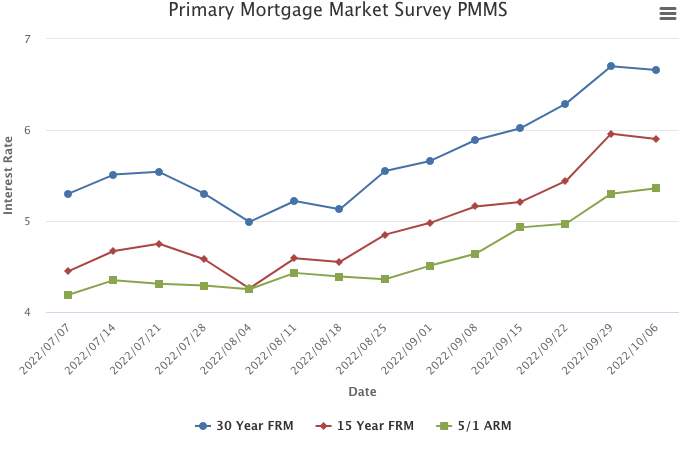

Mortgage rates decreased slightly this week due to ongoing economic uncertainty. However, rates remain quite high compared to just one year ago, meaning housing continues to be more expensive for potential homebuyers.

Information provided by Freddie Mac.