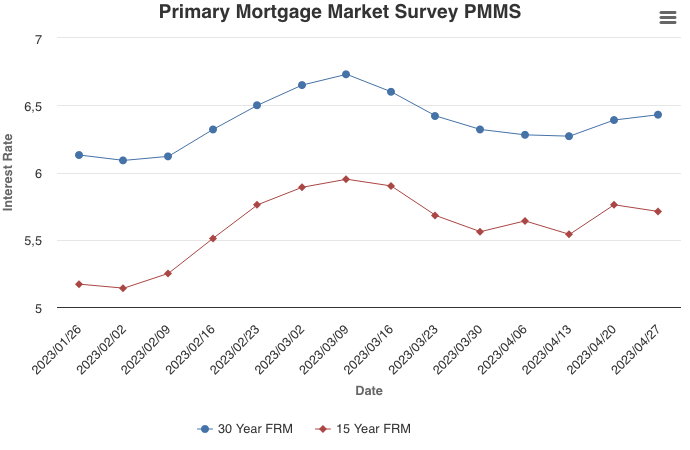

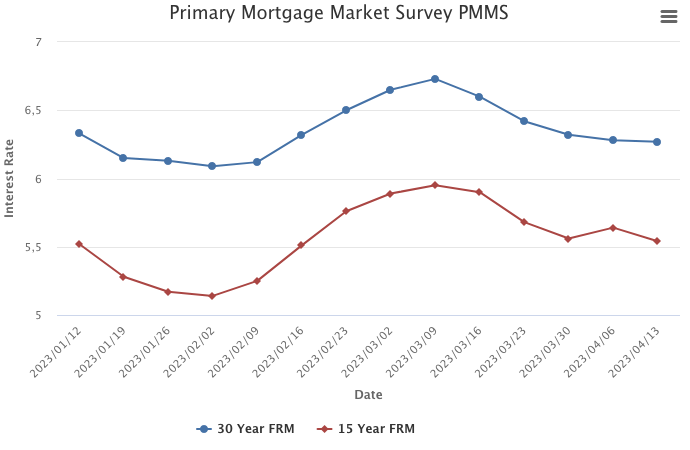

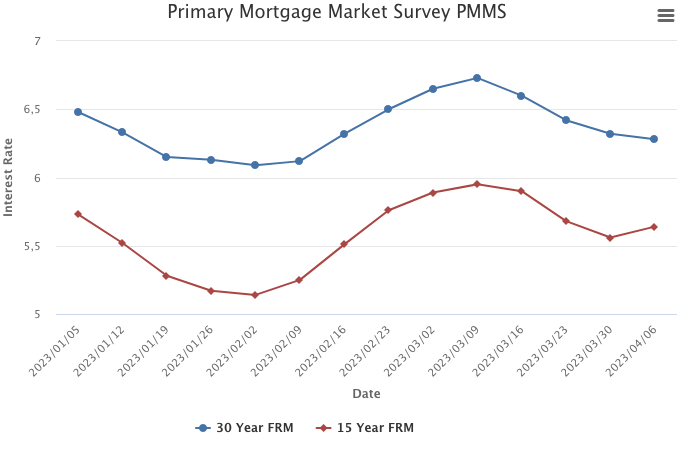

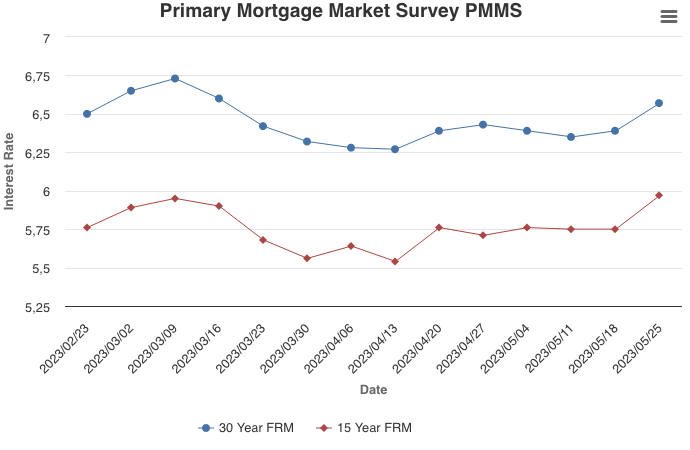

May 25, 2023

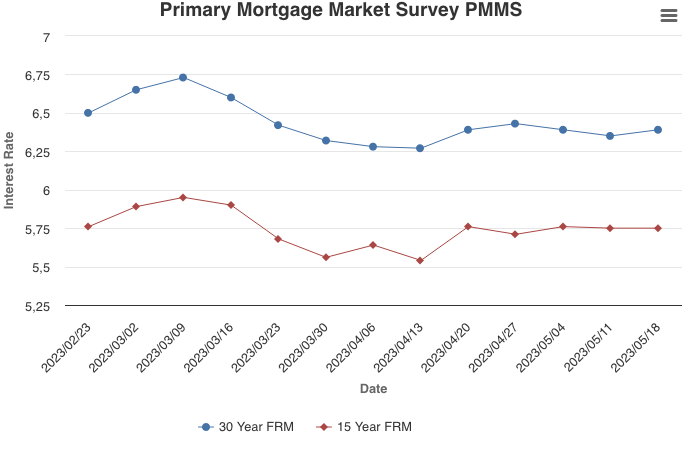

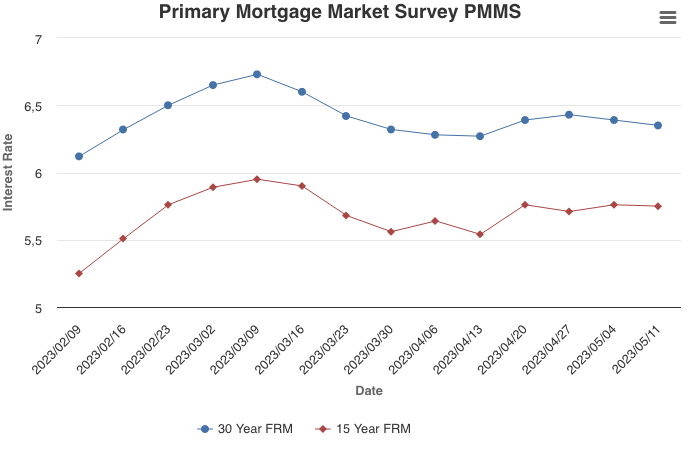

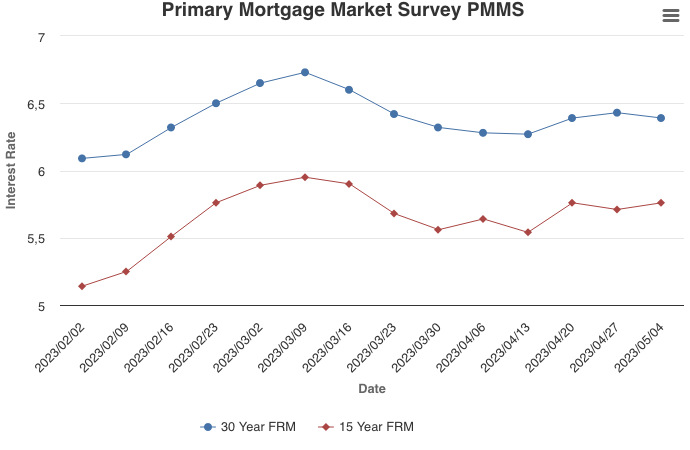

The U.S. economy is showing continued resilience which, combined with debt ceiling concerns, led to higher mortgage rates this week. Dampened affordability remains an issue for interested homebuyers and homeowners seem unwilling to lose their low rate and put their home on the market. If this predicament continues to limit supply, it could open up an opportunity for builders to help address the country’s housing shortage.

Information provided by Freddie Mac.